INCOME TAX PAYMENTS ON ACCOUNT

Released On 4th Feb 2024

As we are approaching the deadline for payments to HMRC for the balancing payment for 2022/23 and the payments on account for 2023/24, it is worthwhile considering available options.

Generally, payments on account must be paid where the liability for the previous year exceeds £1,000. If these payments are not made, HMRC can charge interest for late payment. The interest rate is currently 7.75%, which could lead to large interest charges if the payments are not made.

It is possible to reduce the amount due if you think profits will be lower, which could be likely with the recent decrease in milk prices. However, if your profits don’t decrease, you would then have interest due on the late payments, which should have been made. It is possible however, to reduce your payments on account with the use of farmers averaging, without having the risk of paying interest if profits don’t fall. This could be the case following a year of bumper farming profits.

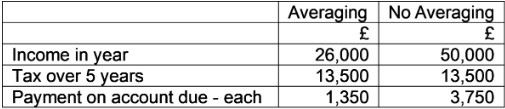

Farmer’s averaging can reduce your payments on account, so while averaging may not save tax, it can still be beneficial to average to provide a cashflow advantage. This is because payments on account are based on the income taxed in this year, and doesn’t include those profits averaged back to earlier years, see the table below:

For ease, the above is based on farming profits this year of £26,000, the total profits the previous four years being £80,000 and a personal allowance being available of £12,500 in each year.

While this shows that there is no overall income tax saving, the cash flow saving is very beneficial. However, please be aware that where this is used, if profits do remain high, this can lead to large tax payments the following year, where payments haven’t been made on account.

If you think this could benefit you, please contact us to review your position.