ARE FAMILY BUSINESSES SUCCESSFUL?

Released On 15th Mar 2023

Succeeding as a Family Business

Some say to never mix family and business.

It’s true that family businesses come with unique challenges but where these are well managed and the family can deliver a great a great product or service, family businesses can be some of the most successful businesses around - Dyson, JCB and Clarks are all incredible examples of this.

Sadly, where these challenges are not properly considered they can lead to business failure or a break down in family relations. So what are some of the things you need to consider to avoid this happening?

Understand the interests of all those connected with the business:

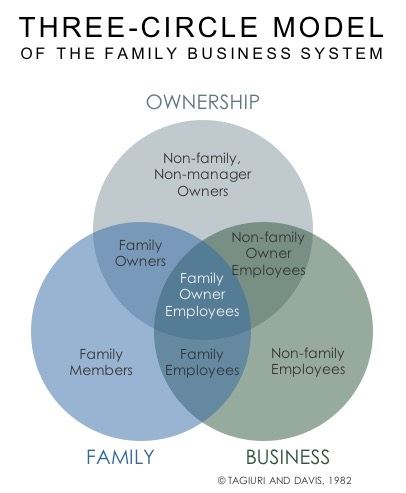

In 1982 John Davis and Renato Tagiuri of the Harvard Business School created the 3 circle model (below) for understanding the relationship between the owners, business and family in a family business.

The 3 circles show 7 sections of pressure and interaction, and individuals can move between sections during the life of a family business. Understanding the interests of each group, where conflicts can arise, and the potential impact of key decisions on each section is vital to retaining harmony in the family.

Clear remuneration strategy

There are many different ways in which family members can be remunerated for their contribution to the business but where there are different levels of contribution by individuals it is of utmost importance that there is a clear distinction and understanding of the reward for working in the business and the equity reward for ownership of the business.

Where remuneration strategies are not fully understood by family members there is a much higher risk of family members becoming demotivated, or worse, falling out with each other.

Wide support network

Every family business is different and will encounter challenges at different times. You won’t know all of the answers all of the time and it’s therefore important to have a trusted network around you that you can turn to for support and advice.

On occasions, it may be that you can turn to those close around you. This might be other family members or employees – both are likely to feel a great sense of loyalty to the business and an environment which encourages open and honest conversation may help find the answer to the question.

On other occasions you may require views from individuals with more independence. This might include fellow family business owners, independent / non exec board members or professional advisors.

Succession or continuation?

For the older generation, succession planning is something often put off due to concerns about the closing of a big chapter in their life, and fear about what the next phase will look like. Thoughts such as how will I fill my time? What’s my purpose going to be? Will the business survive without me? are all too common and delay the important discussions from taking place.

The reality is that succession is likely to be a much more gradual process. Management succession and ownership succession are too very different things and thinking of it as business continuity planning rather than succession planning may help overcome some of those initial fears.

In our view it is never too early to involve the next generation in conversations regarding the future of the business.

Protection when something goes wrong

Divorce, ill health and death are all examples of things which can have a significant detrimental impact on the business.

It’s important to consider how the business could continue to function in each of these scenarios and what protection can be put in place to minimise the pain and disruption caused in each case.

Partnership, shareholder and pre or post nuptial agreements to protect family assets may be important a swell as considering the need for insurance policies such as shareholder protection, life assurance, income protection and critical illness cover to mitigate the financial impact during times of distress.

If you are looking for advice in connection with your family business our experienced advisors are here to help.